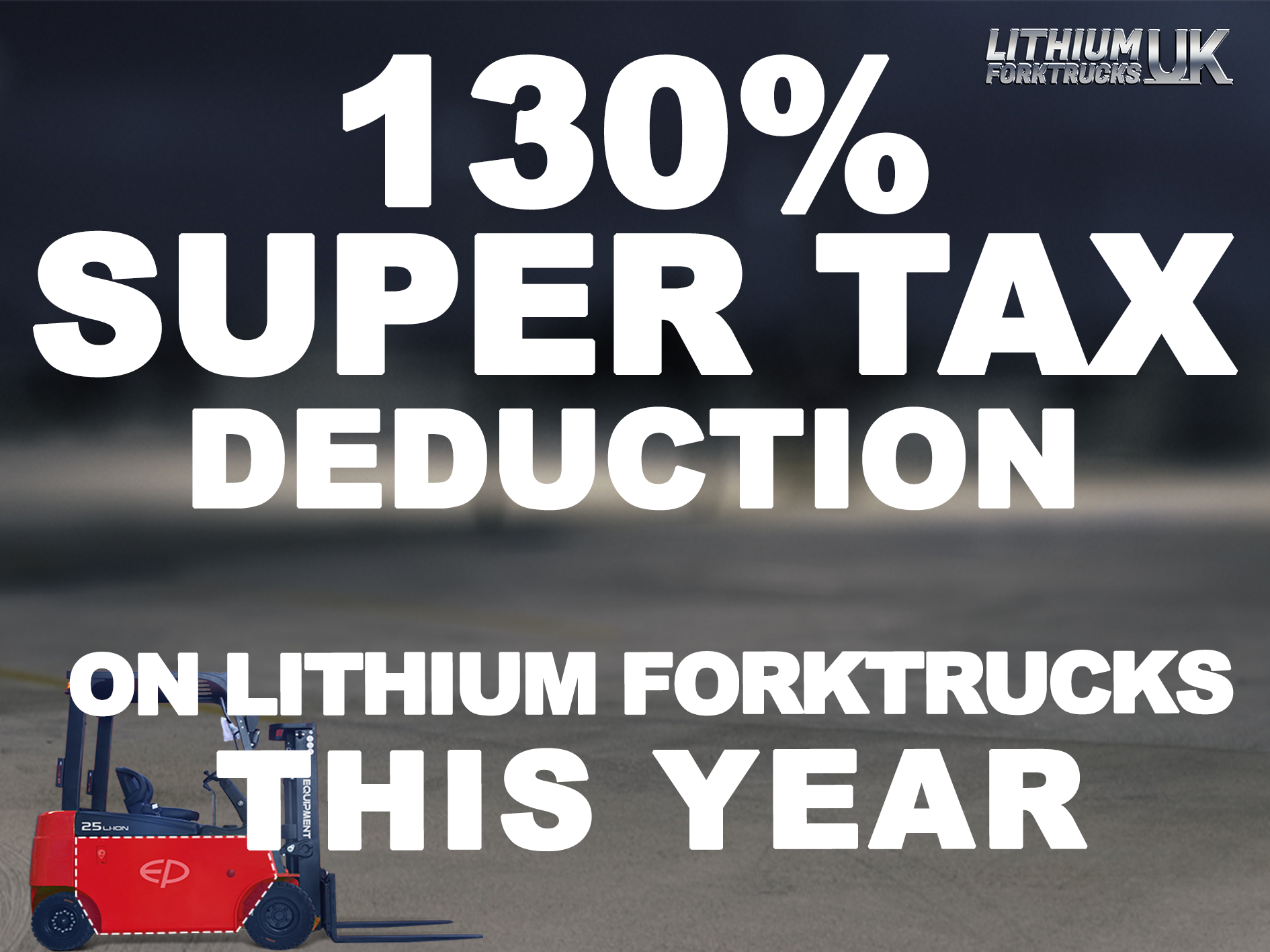

New “super deduction” capital allowances for companies

Designed to stimulate business investment, the majority of UK businesses are eligible for the temporary tax relief on qualifying capital assets from the 1st April 2021. Implemented to spur investment in the wake of the COVID-19 pandemic, the temporary tax relief, known as the ‘super-deduction’, is an enhanced first-year allowance that exceeds the entire cost of the asset. This means, businesses can write off the total cost of the asset against their taxable income.

So how will the new super-deduction work?. The deduction enables companies to claim capital allowances of 130% of the cost of all qualifying expenditure, enabling them to generate a £24.70 reduction in corporation tax for every £100 invested on qualifying expenditure.

The new temporary relief is only available for qualifying expenditure incurred between 1 April 2021 and 31 March 2023. Applicable to main rate assets only, Lithium forklift trucks & material handling equipment have made the cut.

Created for businesses, large or small. This measure is predicted to have positive impact on business investment for the period that it will apply. It will do so by reducing the tax-adjusted cost of capital for millions of companies investing in new plant & machinery assets.

The conditions businesses must meet to apply for this temporary super deduction tax relief on capital assets includes the following:

Lithium forklift trucks meet the necessary criteria, as they are classified as a main rate asset. Which means, if you buy a new lithium forklift truck or material handling equipment, you will qualify for the 130% super-deduction, as long as all the necessary conditions are met.

Because Lithium is for everyone….

We suggest that all businesses considering purchasing from Forktruck Solutions seek further information from HM Revenue & Customs, with the intention that our customers can fully write off the cost (and some more) when they switch their forktruck fleet or material handling equipment to clean lithium electric.

Further advice:

Contact Lithium Forktrucks UK on 01924 265623

Email: info@lithiumforktrucks.uk

If you have any questions about this change, you can also contact HMRC on email: contact.capitalallowances@hmrc.gov.uk.